Dearbail Jordan

Business reporter, BBC News

Getty Images

Getty Images

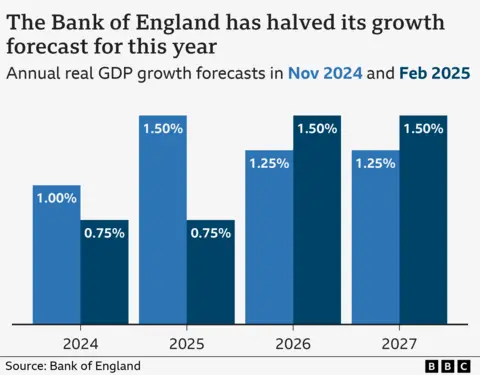

The Bank of England has halved its growth forecast for this year as it cut interest rates to the lowest level for more than 18 months.

The economy is now expected to grow by 0.75% in 2025, the Bank said, down from its previous estimate of 1.5%, although it is narrowly expected to avoid a recession.

The downgrade is a blow for the government and Chancellor Rachel Reeves, who has made growing the economy one of her key aims.

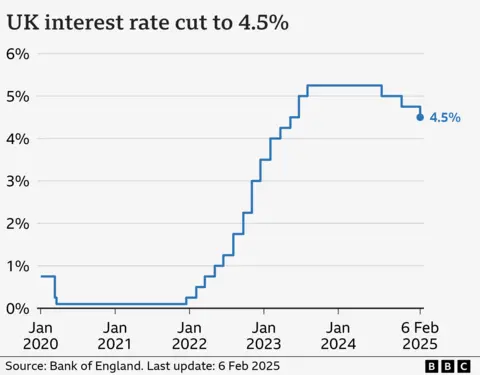

The Bank's new forecast came as it cut interest rates to 4.5% from 4.75% in a move that had been widely expected.

While it cut its forecast for 2025, the Bank increased its prediction for growth in both 2026 and 2027. The economy is now expected to grow by 1.5% in both of those years, the Bank said, up from 1.25%.

However, it also predicted that higher energy and water bills would push up inflation "quite sharply" later this year.

Inflation - the rate at which prices rise - is now expected to rise to 3.7% and take until the end of 2027 to fall back to its 2% target.

The Bank said it would take a cautious approach to future interest rate cuts as it weighs up a number of factors that could affect inflation, including threats of trade tariffs from US President Donald Trump.

"We'll be monitoring the UK economy and global developments very closely and taking a gradual and careful approach to reducing rates further," said Bank of England governor Andrew Bailey.

"Low and stable inflation is the foundation of a healthy economy and it's the Bank of England's job to ensure that."

At the press conference to discuss the forecast, Mr Bailey said the Bank expected to be able to cut rates further "but we will have to judge meeting by meeting, how far and how fast".

"We live in an uncertain world, and the road ahead will have bumps on it," he added.

Last week, the Chancellor, Rachel Reeves, announced a number of measures to try to boost the UK's performance.

However, her decision in last year's Budget to increase employers' National Insurance contributions has led to a wave of criticism from businesses, who argue it will push up prices and hit investment and jobs.

Reeves said the latest interest rate cut was "welcome news".

"However, I am still not satisfied with the growth rate. Our promise in our Plan for Change is to go further and faster to kickstart economic growth to put more money in working people's pockets," she said.

Shadow chancellor Mel Stride said while the rate cut would be good news for many families and businesses, the government's "disastrous Budget" was likely to mean fewer rate cuts this year than expected.

Paul Johnson, director of the Institute for Fiscal Studies think tank, said it was "very worrying" for the government that the Bank of England has "really, quite significantly" downgraded its forecasts for economic growth.

He added that if the official government forecaster - the Office for Budget Responsibility - changes its forecast in line with the Bank's then "the chancellor is in big trouble" when it comes to meeting her debt rules.

"That means... the tax revenues the chancellor is relying on are unlikely to come in as expected, and even tougher choices on spending and tax going forward."

Mortgage impact

The rate cut means that for the 629,000 homeowners on mortgage tracker deals that move in line with the base rate, there will typically be a £29 fall in monthly repayments, according to figures from banking trade body UK Finance.

The near 700,000 people on standard variable rate mortgages will have to wait to see if their lender responds.

Those on a fixed mortgage deal will see no immediate change, but there might be cheaper deals available for new and renewing customers.

However, the rate cut is likely to lead to lower returns for savers.

Nicola Price would like to see rates fall further

Nicola Price and her husband John have still got 18 months remaining on their current mortgage deal, and welcome lower interest rates as it means they will pay less interest on their next mortgage - if rates remain low.

Nicola wishes for "certainly no more increases" and thinks the sweet spot for her would be a rate of around 3%.

However, the couple also see that falling interest rates aren't good news for everyone as their parents "rely heavily" on a better interest rate on their savings.

In its quarterly inflation report, the Bank said economic growth had been "broadly flat since March last year".

The UK economy showed zero growth between July and September.

For the following three months, the Bank of England now expects it to shrink by 0.1% against a previous forecast of 0.3% growth.

A recession is defined as two consecutive three-month periods of economic contraction.

The Bank now expects the economy to grow by just 0.1% between January and March, down from the 0.3% it had predicted in November.

The latest official growth figures for the UK economy will be published next Thursday.

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It'll be delivered straight to your inbox every weekday.

Movie

Movie 2 months ago

78

2 months ago

78

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)