Michael RaceBusiness reporter

Getty Images

Getty Images

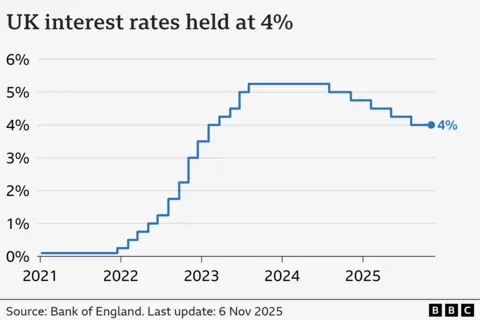

Interest rates were held at 4% in a tight vote as the Bank of England said it judged inflation in the UK to have peaked.

Policymakers voted 5-4 in favour of leaving rates unchanged on Thursday but said borrowing costs were "likely to continue on a gradual downward path".

Bank governor Andrew Bailey said rather than cutting interest rates now, he would "prefer to wait and see" if price rises continued to ease this year.

The Bank's decision comes ahead of the government's Budget on 26 November, where speculation has grown that Chancellor Rachel Reeves will raise taxes.

The chancellor has not ruled out raising income tax, National Insurance or VAT - a move that would breach Labour's main manifesto pledge.

Reacting to the Bank's latest decision, Reeves said the latest forecast "shows that inflation is due to fall faster than previously predicted".

"At the Budget later this month I will take the fair choices that are necessary to build the strong foundations for our economy so we can continue to cut waiting lists, cut the national debt and cut the cost of living."

Inflation - the rate at which prices rise - currently stands at 3.8%, nearly double the Bank's target of 2%. A drop in the rate of inflation does not mean that prices are falling, but that prices are rising at a slower rate.

Despite judging inflation to have peaked, the Bank said evidence suggested in its quarterly update on the UK economy that there was "no sign of increasing consumer confidence".

"Consumers remain cautious, focused on value, and prefer saving to overspending," it said.

It said while supermarkets had reported strong food sales growth, it was driven by price rises, with volumes staying flat.

The Bank said it expected food price inflation to remain higher this year before slowing in 2026, citing higher global agricultural prices.

"Households continue to change their shopping habits to reduce spending, such as buying more vegetables and reducing meat consumption," it reported.

Aside from food bills, childcare costs and caring obligations were leading some people to reduce their working hours or "even stop working", the Bank said.

"Fashion retailers report falling sales due to competition from the second-hand market," it said, adding that accommodation providers were seeing shorter stays and restaurants faced "weak demand" with lower spending per visit.

The Bank of England, which is independent of the government, sets interest rates in an attempt to try to keep consumer price rises under control.

Its base rate has an impact on the cost of borrowing for individuals and businesses, including mortgages, and also on returns on savings.

September's inflation figure of 3.8% was unchanged from August. The Bank said the rate had peaked and predicted it was likely to fall "close to 3% early next year" before gradually returning towards 2% in 2027.

Policymakers said the decision to hold rates at 4% was down to wage growth continuing to slow and price rises for services easing.

But it warned the current rates of wage growth and service price inflation needed to fall further for policymakers to be "confident that inflation will fall back to the 2% target".

Yael Selfin, chief economist at KPMG UK, said the close vote "underscores the uncertain backdrop policymakers are navigating ahead of the Budget".

However, she added the Bank's comments suggest "the door remains open for a rate cut at the December meeting".

In its latest Monetary Policy Report, the Bank said UK economic growth would be 1.5% this year, but estimated it would fall to 1.2% next year before rising to 1.6% in 2027 and 1.8% in 2028.

The government has made growing the economy its main priority as part of its efforts to boost living standards.

The Bank forecast the unemployment rate would hit 5% in the final three months of the year and remain around that level until 2028.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing.

But it is a balancing act, as high interest rates can harm the economy as businesses hold off from investing in production and jobs.

Movie

Movie 3 weeks ago

59

3 weeks ago

59

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)