Getty Images

Getty Images

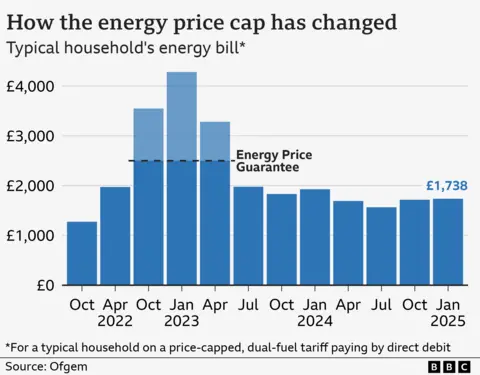

Energy bills for a typical household will rise again in January, with prices expected to remain relatively high throughout the next year.

It is the second rise this winter and means someone paying by direct debit and using a typical amount of gas and electricity will pay £1,738, or £21 a year more, with bills now over 50% higher than pre-Covid levels.

Energy bills have been high for three years, which charities warn has left many struggling to cope and choosing to go without heating at the coldest time of year.

The quarterly cap by regulator Ofgem sets a limit on the cost of each unit of energy, and affects 26 million households in England, Wales and Scotland.

After two relatively mild winters since energy prices soared, billpayers are braced for a colder period that could stretch their finances.

And over the longer term, analysts at the consultancy Cornwall Insight said high domestic energy prices were likely to be "the new normal".

Dame Clare Moriarty, chief executive of Citizens Advice, said the forecasts meant particularly families and people with disabilities faced “impossible choices”.

"For bills to remain at this high level... and with an expectation that they'll remain at that level for the foreseeable future, we're just expecting to see people continuing to be really squeezed, particularly families with children, particularly disabled people."

The cap means a household bill will typically rise by £1.75 a month.

It is also 10% down on the same period last year, but Ofgem said many billpayers would still be stretched.

"We understand that the cost of energy remains a challenge for too many households," said Tim Jarvis, from the regulator.

"However, with more tariffs coming into the market, there are ways for customers to bring their bill down so please shop around and look at all the options."

Debt building up

While the cost of each unit of gas and electricity is capped, the total bill is not. So, a long, cold winter could see higher energy use and high bills.

Energy companies say they have put extra support in place to help customers cope with the situation, such as emergency credit, hardship funds or striking off some debts or standing charges.

However a period of high prices - which analysts say is likely to continue - means households have collectively built up debt of £3.7bn to suppliers.

The average household in arrears owes more than £1,500 for electricity and £1,300 for gas.

The charity National Energy Action said many people were already "rationing their energy use" or building up debt to try to keep warm.

Angela says she is in arrears on her energy bill

Angela, from Liverpool, is one of those who has fallen behind on bills.

As a carer for her mum, she told the BBC she was having to make tough choices.

"I’m over £1,000 in arrears with [my energy supplier] so I don’t put the gas and electric on," she said. "We just sit there with our onesies on of a night. I think it’s terrible, it’s a disgrace."

Close to where she was speaking is Kitty's Laundrette, a co-operative which provides cheap washing and drying for the community, as well as a free service for those who need it.

Anthony Scott is part of the team running it, seeing dozens of customers every day, many of whom are struggling financially.

“I come across a lot of anger, I feel a lot of anger. People are being priced out of using energy in their own home," he said.

Winter fuel payment debate

The cap affects those on default, variable tariffs, not those who have fixed a price for a set period.

It is set every three months by Ofgem, although the regulator illustrates the change by showing the impact on the annual bill of a household with typical energy usage.

To estimate the effect on an individual's annual costs, billpayers can add 1.2% to their current bill.

Some households will have less support than last winter because the final cost-of-living payment was made to eight million people on means-tested benefits in February.

For pensioners, the previously universal winter fuel payment, worth up to £300, is now only being paid only to those on low incomes who receive certain benefits.

According to the government's own estimates, an additional 50,000 pensioners will be living in relative poverty next year as a result of cuts to the payment.

However, this fails to take into account any increased uptake of pension credit - which qualifies people for the winter fuel payment.

Energy Secretary Ed Miliband said the UK was "exposed to the rollercoaster of global fossil fuel markets", which was why the government was concentrating on generating power in the UK.

He admitted the latest price rise would "concern" many families.

Some pensioner households affected in Northern Ireland will receive a one-off £100 payment.

The energy market is regulated differently in Northern Ireland, and is not governed by the same price cap.

Standing charges almost unchanged

The latest change in prices means:

Gas prices are capped at 6.34p per kilowatt hour (kWh), and electricity at 24.86p per kWh - up from 6.24p and 24.5p respectively. A typical household uses 2,700 kWh of electricity a year, and 11,500 kWh of gasHouseholds on pre-payment meters are paying slightly less than those on direct debit, with a typical bill of £1,690Those who pay their bills every three months by cash or cheque are paying more, with a typical bill of £1,851Standing charges - a fixed daily charge covering the costs of connecting to a supply - have fallen very slightly to 60.97p a day for electricity and 31.65p a day for gas, compared with 60.99p and 31.66p respectively, although they vary by region

How some pensioners can claim support

Hundreds of thousands of low-income pensioner households eligible for pension credit currently fail to claim it.

The government says it is worth an average of £3,900 a year and claiming it can qualify people for other financial support such as winter fuel payments.

You can check your eligibility for pension credit via the government's online calculator.

Information is also available on how to make a claim. There is also a phone line available on weekdays - 0800 99 1234.

Guide to benefits, when you qualify and what to do if something goes wrong, are provided by the independent MoneyHelper website, backed by government.

Benefits calculators are also run by Policy in Practice, and charities Entitledto, and Turn2us.

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It’ll be delivered straight to your inbox every weekday.

Movie

Movie 3 months ago

94

3 months ago

94

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)