JORDAN PETTITT/PA WIRE

JORDAN PETTITT/PA WIRE

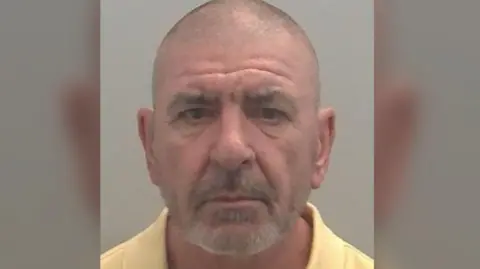

Stanley admitted dishonestly making false representations to members of the Layezy Racing Syndicate

A former police officer who funded his lavish lifestyle by duping thousands of people involved with a horse racing betting syndicate has been jailed.

Michael Stanley admitted misusing money from members of the Layezy Racing Syndicate for several years before his arrest in 2019.

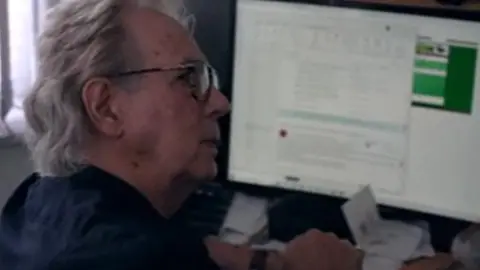

Terry Wildey, a retired hairdresser from Kent, said he and his family had put £200,000 into the scheme after he encouraged his own relatives to invest.

"He's a rat isn't he," he told the BBC, after Stanley was sentenced to six years' imprisonment at Maidstone Crown Court.

"He consciously set that up with the sole intention of taking people's money."

About £44m was paid into the scheme and an estimated £34m was given back to members, leaving a £10m shortfall which remains unaccounted for.

One victim lost nearly £500,000, the court heard.

The former Kent Police sergeant, 68, pleaded guilty to running the "Ponzi scheme" in March.

KENT POLICE

KENT POLICE

Stanley was sentenced at Maidstone Crown Court on Tuesday afternoon

The court was told the syndicate started out with family and friends and grew to more than 6,000 members, and had a waiting list of 3,000 people at the time it collapsed.

It also heard that Stanley, from Walderslade, used some of the money to buy himself a £400,000 property in Spain, jewellery and 23 race horses.

He also bought £1.6m in cryptocurrency and £622,000 worth of silver bullion.

The judge told Stanley: "Your conduct was not reckless, but deliberate, sustained and repeated. When people gambled with you, they did not know the true odds. They were told lies."

Stanley, who gained the trust of members thanks to his background as a police officer, was also banned from being a director of a company for 15 years.

Mr Wildey said he got family members involved - including his children, his wife, his mother-in-law and his brother-in-law - because a financial incentive was offered to do so, whereby members got a percentage of any 'winnings' of the people they referred.

“Initially [I put in] £1,000, just to try it out," he said.

"And then you get a portal and you can watch your money grow. And I watched my money grow, and I thought ‘my money’s not growing fast enough because it’s not big enough’, so I put more money in."

“I always have doubts, with anything that looks like it’s easy money.

“But I never had any doubts going into it because my friends had all made money. And I always thought it was genuine.”

Mr Wildey said the long wait to join the scheme made it seem like an "exclusive club"

Det Sgt Alec Wood, head of complex fraud at Kent Police’s economic crime unit, said the case was largest fraud the force had ever prosecuted.

Stanley left the profession more than 40 years ago, and Det Sgt Wood said his behaviour did not “reflect the current professionalism and dedication” of officers.

He said Stanley had made “various promises” privately and publicly to members about the scheme’s success.

“Ultimately, when we looked at the evidence this was manifestly false and that was effectively the fraud,” he added.

He described the syndicate as a “clear Ponzi scheme”, adding that in one year, Stanley lost £1m with a betting company.

“The impact on these victims has been utterly immense, many have lost their pensions, their life savings, their medical insurance payouts and they’re facing a very uncertain future as a result of Mr Stanley’s dishonesty,” said Det Sgt Wood.

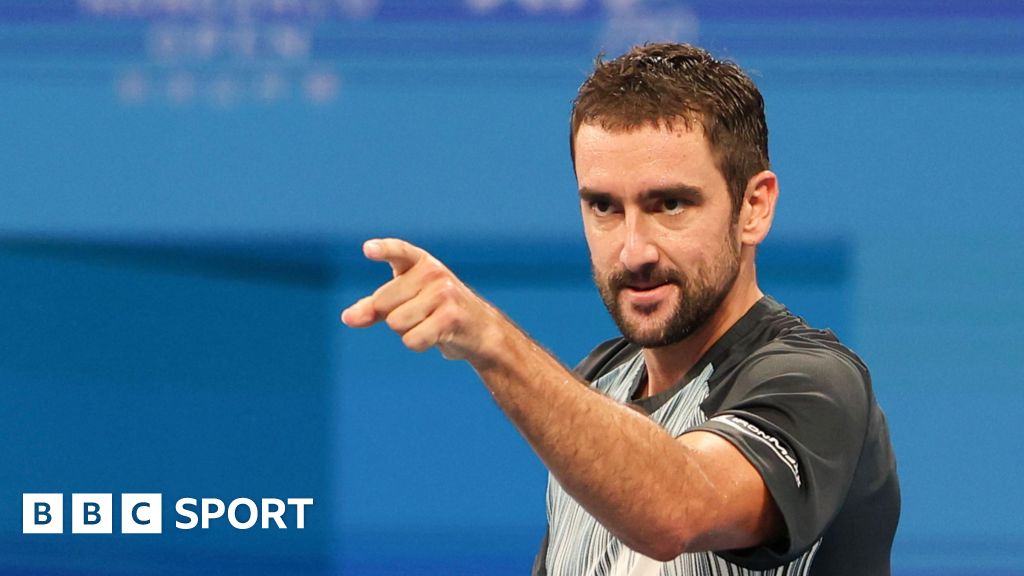

Angela Elven said Stanley had impacted "so many people's lives"

Angela Elven, who invested about £5,000 in the scheme, told the BBC that while members of the syndicate took “a gamble”, they believed Stanley because “he seemed like a very genuine person”.

“He’s affected so many people’s lives, so he should pay for what he’s done,” she said.

Ms Elven, whose daughter also invested in the scheme, said she had not yet been able to retrieve her investment.

“We haven’t got lots of money. I know that there’s lots of people that have put an awful lot more than we have in, but it’s a lot of money to us,” she said.

Movie

Movie 2 hours ago

9

2 hours ago

9

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)