Ben KingBusiness reporter

Getty Images

Getty Images

European stock markets recovered some ground after a warning of fraud from two US banks triggered a sell-off in banking shares around the world.

Two US regional lenders, Western Alliance Bank and Zions Bank, said on Thursday that they had been hit by either bad or fraudulent loans, sparking fears of problems in the wider sector.

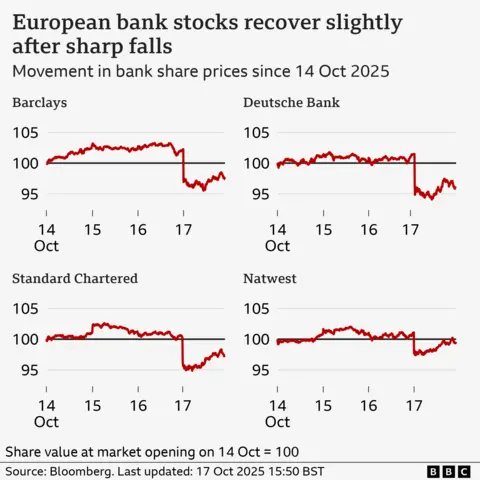

Some of the UK's biggest banks, including Barclays and Standard Chartered, saw their share prices fall more than 5% on Friday morning, before recovering slightly before the end of the day's trading.

The FTSE 100 index of leading shares had dropped about 1.5% at one point before coming back slightly to close 0.9% lower.

The US S&P 500 benchmark was marginally up after Donald Trump appeared to indicate that high tariffs on China may not be "sustainable".

On Thursday, Zions Bank said it would write off a $50m loss on two loans, while Western Alliance disclosed it had started a lawsuit alleging fraud.

"Pockets of the US banking sector including regional banks have given the market cause for concern," said Russ Mould, investment director at AJ Bell.

"Investors have started to question why there have been a plethora of issues in a short space of time and whether this points to poor risk management and loose lending standards."

"Investors have been spooked," he added, saying that while there was no evidence of any issues with UK-listed banks, "investors often have a knee-jerk reaction when problems appear anywhere in the sector".

Bank shares in Europe were also hit, with Germany's Deutsche Bank ending the day 6% lower, and France's Societe Generale closing down 5%.

The main stock market in Germany closed down 1.8%, while the Cac 40 in Paris was finished the day down just 0.2%.

Asian markets fell earlier on Friday. Japan's Nikkei index closed down 1.4% and in Hong Kong the Hang Seng Index was 2.5% lower.

But shares of some of the US banks hit hardest on Thursday appeared poised to claw back some ground.

In early afternoon trade on Friday, shares in Zions Bank were up about 4%, following its 13% fall on Thursday. Shares in Western Alliance Bancorp, which had dropped almost 11%, were also up nearly 2%.

In an interview on the Fox Business Network, the director of the White House National Economic Council described the issues as "messes" left by the Biden administration, while maintaining that US banks were well positioned to handle the stress.

"Right now, the banking sector has ample reserves," Kevin Hassett said. "We're very optimistic that we can stay way, way, way ahead of the curve on this."

Investors have been nervous following the failure of two high-profile US firms, car loan company Tricolor and car parts maker First Brands.

These failures have raised questions about the quality of deals in what is known as the private credit market - where companies arrange loans from non-bank lenders.

This week Jamie Dimon, the boss of the US's largest bank JPMorgan Chase, warned that these two failures could be a sign of more to come.

"My antenna goes up when things like that happen," he told analysts. "I probably shouldn't say this, but when you see one cockroach, there are probably more. Everyone should be forewarned on this one."

There have also been warnings that the surge in artificial intelligence investment has produced a bubble in the US stock market - including from Mr Dimon - leading to fears that shares are overvalued.

The market turbulence on Friday saw the price of gold reach a fresh record high of $4,380 per ounce, as investors looked for safe havens for their money.

Another closely watched measure of market nerves, the VIX volatility index sometimes called the "Fear Index", hit its highest level since April.

Movie

Movie 1 month ago

158

1 month ago

158

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)