Michael Race

Business reporter, BBC News

BBC

BBC

Chancellor Rachel Reeves has refused to rule out future tax rises after the UK economy suffered its worst contraction for a year and a half in April.

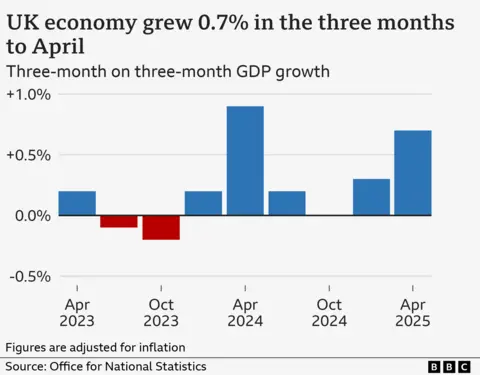

The economy unexpectedly shrank by 0.3% after taxes increased for businesses, household bills jumped and exports to the US plunged.

The figures come a day after Reeves set out spending plans aimed at boosting growth, with funding increases for the NHS and defence, but budgets squeezed elsewhere.

Economists warned that a failure to increase UK growth would "almost certainly" lead to more tax rises later this year for the government to balance its spending commitments.

Reeves acknowledged the latest economic figures were "clearly disappointing" and refused to rule out tax rises when she next lays out her plans for the economy in the autumn Budget.

"No chancellor is able to write another four Budgets in the first year of a government, you know how much uncertainty there is in the world at the moment," she told the BBC.

Monthly figures on the economy are volatile, and the more stable three-month figure to April showed the economy grew by 0.7%.

"With spending plans set... any move in the wrong direction will almost certainly spark more tax rises," said Paul Johnson, director of the Institute for Fiscal Studies (IFS), an influential think tank.

In Wednesday's Spending Review, Reeves prioritised ploughing billions into long-term projects, in a bid to boost economic growth and improve living standards.

But many of the chancellor's plans such as new railway lines and the development of nuclear power plant Sizewell C will take years, with current day-to-day spending budgets being squeezed.

Council tax is also expected to rise to pay for local services.

Opposition parties said the chancellor's previous decision to raise employers' National Insurance contributions, which took effect in April, was dragging on growth.

The government is also paying more to borrow money.

Lindsay James, investment strategist at British multinational wealth management company Quilter, said this was due to investors being cynical over the government's spending plans so demanding a higher return.

"With the economy now weakening, we can expect to see concerns around further tax rises increase as we near the autumn Budget – which is likely to weigh on growth even more."

Growth rising steadily is widely welcomed, as it usually means people are spending more, extra jobs are created, more tax is paid, and workers get better pay rises.

But growth in the UK has been sluggish for many years.

The Office for National Statistics said a poor month for the services sector, which includes businesses ranging from shops and restaurants to hairdressers and financial firms, was behind the contraction in April.

Legal firms and property companies also "fared badly", it said, following a strong March which saw many homebuyers rushing to complete purchases to avoid stamp duty increases that came in in April.

Car manufacturing was also weak after the introduction of 25% tariffs on UK vehicles exported to the US. Cars are the UK's biggest US export, with one in eight cars built in Britain shipped across the Atlantic.

Trade data showed the value of UK exports decreased by some £2.7bn in April, with goods to America alone falling by £2bn, the largest monthly fall on record in exports across the Atlantic.

Since April, the government has agreed a deal on tariffs with the US and has also made trade agreements with the European Union and India.

Despite the tariff pact with the US, a 10% import tax still applies to most UK goods entering America, with higher taxes for steel and cars until the deal comes into force.

Ollie Vaulkhard, director of Vaulkhard Group which owns 17 hospitality venues across Newcastle upon Tyne, said the business was under pressure from the cost increases.

"Each one of those is manageable - you put them all into a pot, ultimately we've got to charge our customers more," he said.

Grace Sangster, who is on an apprenticeship scheme earning £40,000, said the government should do more to help first-time buyers.

She and her partner Ollie Vass, both 19, bought their first home in April, but said due to the stamp duty increases, the couple had to pay £3,125, as opposed to zero previously.

'More taxes coming'

Shadow chancellor Mel Stride blamed Reeves' economic choices for the weak growth.

"The chancellor should have taken corrective action to fix the problems she has caused. But instead her Spending Review has all but confirmed what many feared: more taxes are coming."

Liberal Democrat Treasury spokesperson Daisy Cooper said the figures were a "wake-up call for the government which has so far refused to listen to the small businesses struggling to cope with the jobs tax".

In April, employers' National Insurance contributions rose to 15% from 13.8%, with the threshold for payments reduced from £9,100 per year to £5,000.

Firms also saw minimum wages and business rates go up.

Movie

Movie 2 months ago

121

2 months ago

121

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)