Image source, Reuters

Image source, Reuters

By Natalie Sherman

Business reporter, New York

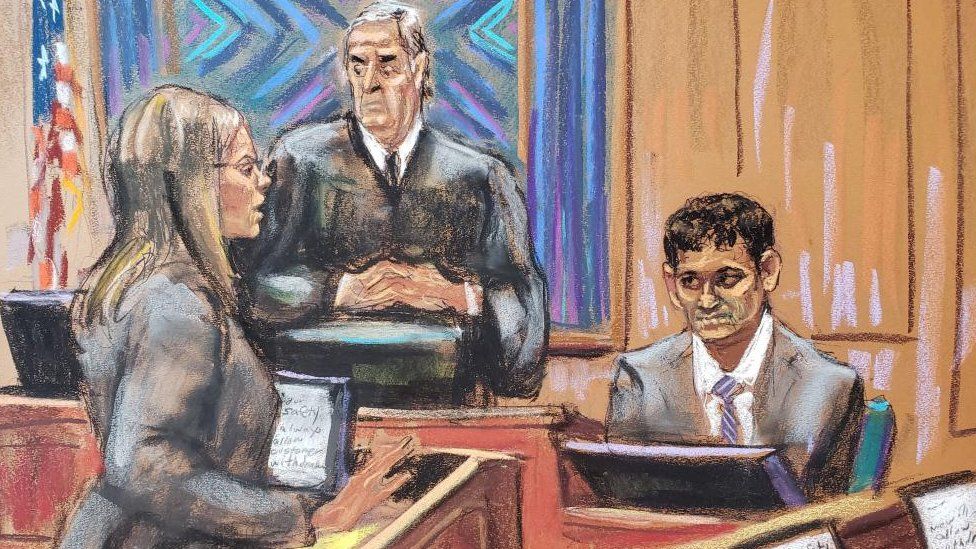

US prosecutors pounced on public statements made by Sam Bankman-Fried as they finished cross-examining him on Tuesday about the collapse of his crypto empire.

They said there were inconsistencies between his media remarks and how his crypto exchange FTX was managed.

The 31-year-old is accused of lying to investors and lenders and of stealing billions from customers.

He denies the charges and says he acted in good faith, but made mistakes.

Closing arguments are expected to start on Wednesday, after a hearing with attorneys in which the judge will decide what instructions to give the jury as it considers the charges against tech entrepreneur.

Since the start of testimony last Thursday, prosecutors have pushed Mr Bankman-Fried, a high-profile public figure as head of the now-defunct FTX, about his past comments and social media posts.

In them he claimed that protecting customer and investor funds was a "priority" for the company, while at the same time his crypto trading firm, Alameda Research, was borrowing billions of dollars from FTX customers' deposits.

The court heard earlier in the trial from Caroline Ellison, Mr Bankman-Fried's ex-girlfriend and deputy, that Alameda ultimately took about $14bn (£11.4bn) from FTX clients, using it for investments and repaying lenders.

He testified Tuesday that he knew as early as 2020 that FTX customer funds were being held in a bank account controlled by Alameda, and that he did not recall instructing Alameda employees to safeguard those funds.

Prosecutor Danielle Sassoon pressed Mr Bankman-Fried to explain why he had not tried to understand what was happening between Alameda and FTX by June 2022, when it appeared at one point that the trading firm had gone bankrupt.

Mr Bankman-Fried tried to parry her questions, expressing a mix of defiance, regret and frustration at comments and actions he felt were being taken out of context.

He said that he had "trusted" that his former friends and deputies had the situation under control.

"I was told they were busy and should stop asking questions," he said.

Mr Bankman-Fried testified he thought it was "permissible" for Alameda to spend FTX customer funds but had not been aware until October 2022, just a few weeks before the bankruptcy, that the company had actually done so.

"I deeply regret not taking a deeper look into it," he said.

Mr Bankman-Fried has maintained that he had been far more absent from decision-making than his friends had suggested, saying he could not recall, for example, going over spreadsheets that had been presented to him.

He has said Ms Ellison failed to "hedge" bets to better protect Alameda from a downturn in the market, as he had instructed her to do. But he acknowledged that he did not take action in response to the failure.

"I wasn't particularly interested in trying to dole out blame," he said, in explaining his decision not to fire anyone. "It generally wasn't something I tried to prioritize as a leader."

At times during Ms Sassoon's questions, Mr Bankman-Fried appeared visibly restless, blinking furiously and shifting back and forth, responding with curt "yeps". Questioned by his own attorney, Mark Cohen, he was more expansive.

Under questioning from Mr Cohen, he said that he had stepped back from Alameda after handing off the chief executive role and was "essentially uninvolved" in core operations like day-to-day trading.

His appearance at the New York court followed 12 days of prosecution testimony in which close former colleagues - who have already pleaded guilty - gave evidence.

During the trial, these witnesses, including Ms Ellison, have emerged from hours of questioning with their credibility seemingly largely unscathed.

Prosecutors have tied Mr Bankman-Fried to decisions to take money deposited at FTX and use it to repay lenders to Alameda Research, buy property, and make investments and political donations.

They say he tried to hide the transfers between the two firms and their close relationship - and lawyers have buttressed their allegations with text messages, spreadsheets and tweets.

He has pleaded not guilty to seven federal charges including wire fraud, securities fraud and money laundering and could face a life sentence in prison if convicted.

Mr Bankman-Fried's defence team has argued he was following "reasonable" business practices, as his companies grew rapidly.

After the collapse of his companies last year, he admitted in media interviews, including with the BBC, to managerial mistakes but said he never intended fraud.

The jury will begin deliberations after Wednesday's closing arguments.

Sam Bankman-Fried denies claims he knew FTX customer money was used for risky financial bets

Movie

Movie 6 months ago

96

6 months ago

96

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)