Getty Images

Getty Images

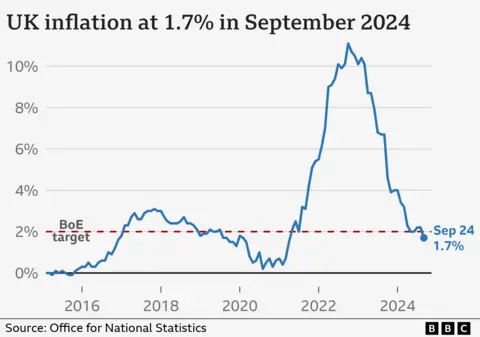

UK inflation fell unexpectedly to 1.7% in the year to September, the lowest rate in three-and-a-half years.

Lower airfares and petrol prices were the main drivers behind the surprise slowdown, official figures showed.

It means inflation - the rate prices rise at over time - is now below the Bank of England's 2% target, paving the way for interest rates to be cut further next month.

September's figure is normally used to set how much many benefits rise, such as Universal Credit, next April.

This includes all the main disability benefits - personal independence payment, attendance allowance and disability living allowance - as well as carer’s allowance.

But a rise of 1.7% for benefits would be less than April's expected rise in the state pension of 4.1%, which is governed by the so-called triple lock.

The Office for National Statistics (ONS) said petrol and diesel prices were significantly lower, dropping by 10.4% in September compared with the same month a year earlier.

The cost of fares for domestic, European and long-haul flights also dragged down the inflation rate. Fares normally fall after the summer rush, but they fell more than normal.

However, households were hit by an uptick in the pace of food and non-alcoholic drink price rises, with costs jumping for milk, cheese, eggs, soft drinks and fruit.

Chief secretary to the Treasury, Darren Jones, said the drop in the pace of price rises overall would be "welcome news for millions of families".

"However, there is still more to do to protect working people, which is why we are focused on bringing back growth and restoring economic stability to deliver on the promise of change," he added.

The surprise fall in the UK's inflation rate comes ahead of this month's Budget, with Chancellor Rachel Reeves looking to make to make tax rises and spending cuts to the value of £40bn.

Movie

Movie 2 months ago

66

2 months ago

66

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)