By Kevin Peachey

Cost of living correspondent

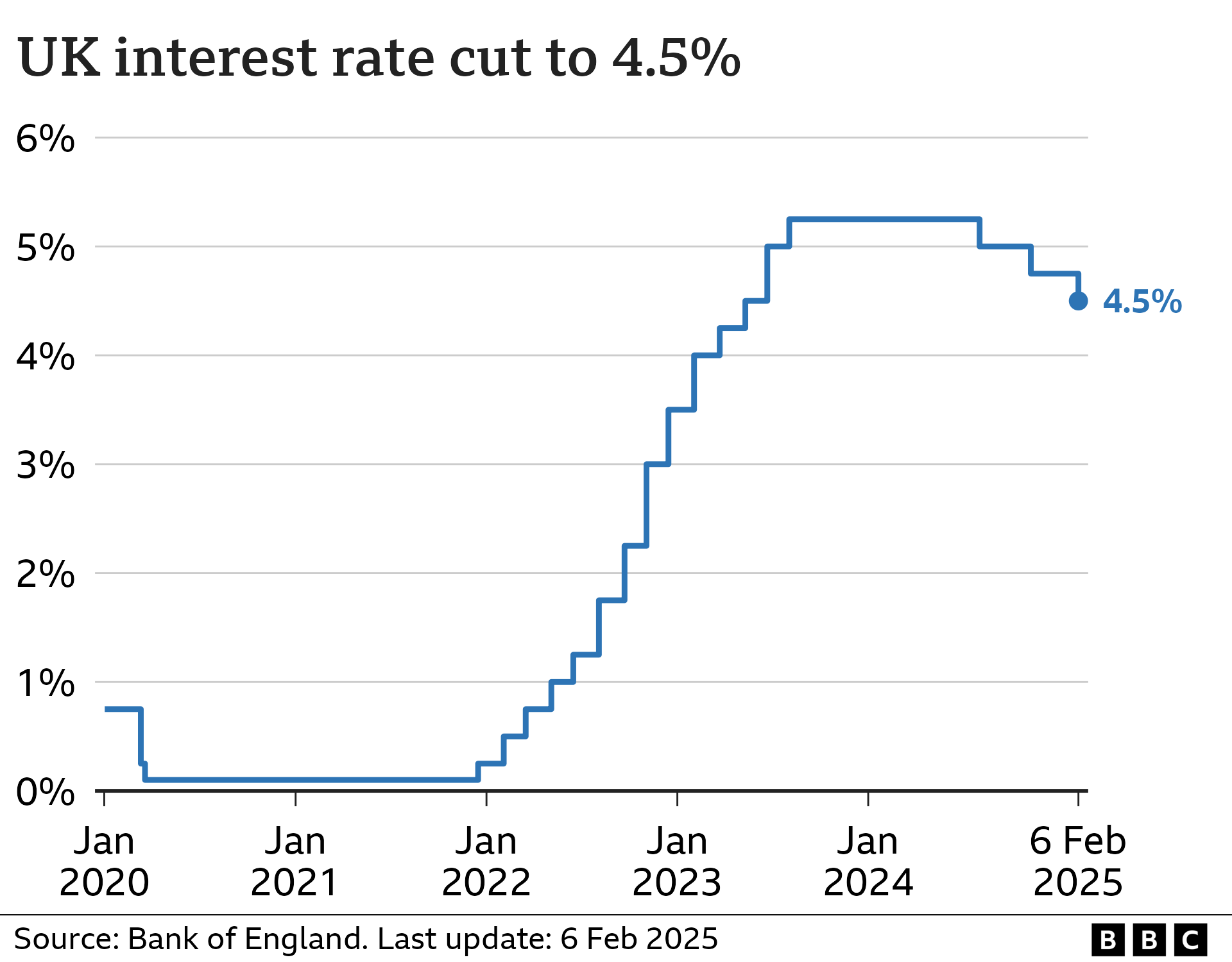

The Bank of England has cut interest rates from 4.75% to 4.5%, their lowest level for 18 months.

It is the third cut since August 2024, but the Bank said it will take a "cautious" approach to further reductions.

Interest rates affect the mortgage, credit card and savings rates for millions of people.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England's base rate is what it charges other lenders to borrow money.

This influences what lenders then charge their customers for loans such as mortgages, as well as the interest rate they pay on savings accounts.

The Bank moves rates up and down in order to control UK inflation - which is the increase in the price of something over time.

It has a target to keep inflation at 2%.

When inflation is high, it may decide to raise rates to bring inflation back down.

The idea is to encourage people to spend less and reduce demand.

Once inflation is at or near the target, the Bank may hold rates, or cut them.

Will UK interest rates go down further?

It is difficult to predict exactly what will happen to interest rates, but the expectation is for more cuts in 2025.

Factors include whether inflation remains at or below the Bank's target, and how the economy is doing more generally.

The main inflation measure, CPI, was 2.5% in the 12 months to December 2024.

Although that is far below the peak of 11.1% reached in October 2022, it remains above the Bank's target of 2%.

After many months of keeping rates at 16-year high of 5.25%, the Bank of England cut them to 5% in August 2024, and again to 4.75% in November. It held rates in December, before the cut to 4.5% in February.

While announcing the February rate decision, the Bank also cut its growth forecast for the UK economy in 2025 from 1.5% to 0.75%.

It expects the UK to only narrowly avoid falling into recession - meaning the economy shrinks for two three-month periods in a row - and predicts that inflation will rise towards 4% later in 2025.

Bank of England governor Andrew Bailey said the Bank will consider further rate cuts, but will take "a gradual and careful approach".

"We live in an uncertain world," he said, "and the road ahead will have bumps on it."

The Bank is concerned about the possible impacts of increases to the amount of National Insurance paid by employers and the minimum wage, both of which take effect in April.

It is also not clear how US President Donald Trump's plans to introduce tariffs on key imports could affect the UK.

Interest rates were significantly above current levels for much of the 1980s and 1990s, and up to the 2008 financial crisis, after hitting 17% in November 1979, external.

When considering whether to cut rates, the Bank has to balance the need to slow price rises against the risk of damaging the economy.

How do interest rates affect mortgages, loans and savings rates?

Mortgage rates

Just under a third of households have a mortgage, according to the government's English Housing Survey, external.

About 600,000 homeowners have a mortgage that "tracks" the Bank of England's rate, so a base rate change has an immediate impact on monthly repayments. A 0.25 percentage point cut would typically save them about £29 on their monthly repayments, according to figures from lenders' trade body UK Finance.

But more than eight in 10 mortgage customers have fixed-rate deals. While their monthly payments aren't immediately affected, future deals are.

Mortgage rates are still much higher than they have been for much of the past decade.

As at 6 February, the average two-year fixed mortgage rate is 5.50%, according to financial information company Moneyfacts, and a five-year deal is 5.30%. The average two-year tracker is 5.46%.

It means many homebuyers and those remortgaging are having to pay a lot more than if they had borrowed the same amount a few years ago.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027.

A hold in interest rates may have relatively little impact on pricing of fixed-rate mortgages in the short-term. The outlook is complicated at the moment as the markets, and lenders, consider the impact of the Budget and other global events. However, the prospect of further falls could give impetus to lenders to cut their rates for new borrowers.

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Credit cards and loans

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to reduce their own interest rates if decisions by the Bank of England make borrowing costs cheaper. However, this tends to happen very slowly.

Image source, Getty Images

Image source, Getty Images

Savings

The Bank of England interest rate also affects how much savers earn on their money.

A falling base rate is likely see a reduction in the returns offered to savers by banks and building societies. The current average rate for an easy access account is about 3% a year.

Any cut could particularly affect those who take the interest from savings to top up their income.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 - the group representing the world's seven largest so-called "advanced" economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%. After a series of cuts it now stands at 2.75%.

In the US, the central bank - the Federal Reserve - held interest rates following cuts at three meetings in a row, meaning its key lending rate has a target range of 4.25% to 4.5%.

However, the Fed has indicated that it will cut rates at a slower pace in 2025.

Movie

Movie 2 months ago

78

2 months ago

78

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)