Getty Images

Getty Images

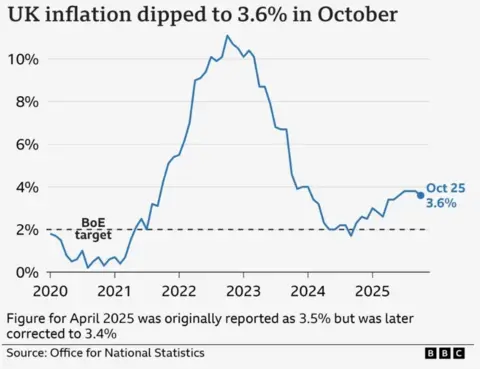

Prices in the UK rose by 3.6% in the year to October, down from 3.8% recorded in August and September.

However, inflation remains well above the Bank of England's 2% target.

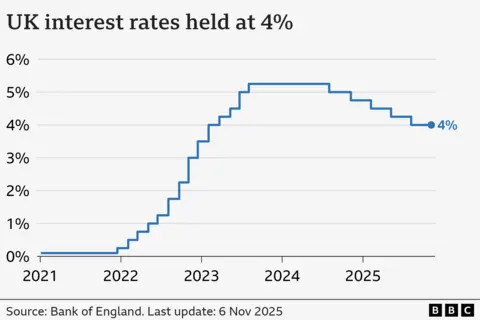

The Bank moves interest rates up and down to try to keep inflation at that level. It has cut five times since August 2024, bringing rates down to 4%.

What is inflation?

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

How is the UK's inflation rate measured?

The prices of hundreds of everyday items, including food and fuel, are tracked by the Office for National Statistics (ONS).

This virtual "basket of goods" is regularly updated to reflect shopping trends, with virtual reality headsets and yoga mats added in 2025, and local newspaper adverts removed.

The ONS monitors price changes over the previous 12 months to calculate inflation.

The main inflation measure is called the Consumer Prices Index (CPI), and the latest figure is published every month.

What is happening to UK inflation?

The Bank also considers other measures such as "core inflation" when deciding whether and how to change rates.

This doesn't include food or energy prices because they tend to be very volatile, so can be a better indication of longer term trends.

Core CPI was 3.4% in the 12 months to October, down slightly from 3.5% recorded in the year to September.

Why are prices still rising?

Although inflation has fallen significantly since the October 2022 high, that doesn't mean prices are falling - just that they are rising less quickly.

Inflation soared in 2022 because oil and gas were in greater demand after the Covid pandemic, and energy prices surged again when Russia invaded Ukraine.

It then remained well above the 2% target partly because of higher food prices.

Food price inflation has continued to be an issue.

It rose to 4.9% in the year to October 2025, and the ONS said this was the biggest factor in the overall inflation rise recorded in the period.

In contrast, there were smaller increases in household energy bills and lower hotel costs.

Why supermarket prices really became sky high in the UKWhy does putting up interest rates help to lower inflation?

When inflation was well above its 2% target, the Bank of England increased interest rates to 5.25%, a 16-year high.

The idea is that if you make borrowing more expensive, people and businesses have less money to spend. People may also be encouraged to save more.

In turn, this reduces demand for goods and slows price rises.

But it is a balancing act - increasing borrowing costs risks harming the economy.

For example, homeowners face higher mortgage repayments, which can outweigh better savings deals.

Businesses also borrow less, making them less likely to create jobs. Some may cut staff and reduce investment.

In recent months, inflation has remained above the Bank's target at the same time as the economy has remained relatively flat and the jobs market has softened.

Therefore, the Bank has chosen to cut rates, despite high inflation, in an attempt to encourage people to spend more and get businesses to invest and create jobs to boost the economy.

What is happening to UK interest rates and when will they go down again?

The Bank of England began cutting rates in August 2024, and has made five cuts to bring them down to 4%, where they have remained.

Are wages keeping up with inflation?

The latest official figures show that regular pay in Great Britain grew by more than inflation between July and September.

Average annual growth in pay (excluding bonuses) during the three-month period was 4.6%, down from 4.7% in the three months to August.

After taking inflation into account, wages grew by 0.8% between July and September.

Annual average regular earnings growth for the period was 6.6% for the public sector and 4.2% for the private sector.

What is happening to inflation and interest rates in Europe and the US?

The US and EU countries have also been trying to limit price increases, but both have lower central bank interest rates than the UK.

The inflation rate for countries using the euro was 2.1% in October, down from 2.2% in September, according to EU data.

In June 2024, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first fall in five years.

By June 2025, after several further cuts, its key rate stood at 2%, where it has remained.

Inflation in the US rose to 3% in September, up from 2.9% in August, and above the US central bank's 2% target.

In October, the Federal Reserve said it was lowering the target for its key lending rate by 0.25 percentage points, which put it in a range of 3.75% to 4%.

The move was the bank's second cut in a row, after holding rates for most of 2025, and was expected to bring down borrowing costs across the US.

The Fed had repeatedly come under attack from US President Donald Trump for not cutting rates.

Movie

Movie 6 hours ago

9

6 hours ago

9

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)