Getty Images

Getty Images

Tax rises in the Budget are expected to hit pay with employers having less cash to give in pay rises.

Chancellor Rachel Reeves has decided firms will bear the brunt of her £40bn total tax rise by increasing the National Insurance rate for employers as well as reducing the threshold at which they start paying it.

Businesses are likely to respond by holding back on pay rises, influential think tanks, the government's independent forecaster and the chancellor herself have all said.

"Even if it doesn't show up in pay packets from day one, it will eventually feed through to lower wages," said James Smith of the Resolution Foundation.

"This is definitely a tax on working people, let's be very clear about that."

Other Budget measures, including a big boost to spending on public services, and other tax rises, are expected to raise inflation in the short term, which could prevent interest rates falling more quickly.

That will also have a knock-on effect on people's spending power.

The government has pledged to make economic growth its priority and said people would have more "pounds in their pockets" by the end of the parliament.

In its general election manifesto, Labour promised not to increase taxes on "working people" - explicitly ruling out a rise in VAT, National Insurance or income tax.

The pledge has come under scrutiny, with some claiming that Labour have broken it with the rise in employer's National Insurance Contributions (NICs), something the government has denied.

Reeves acknowledged on Thursday that the rise in NICs would affect pay.

"It will mean that businesses will have to absorb some of this through profits and it is likely to mean that wage increases might be slightly less than they otherwise would have been," she told the BBC.

The Budget has sparked a debate over how much of the tax rise firms can absorb.

The Office for Budget Responsibility (OBR) forecasts that by 2026-27, some 76% of the total cost of the NICs increase will be passed on through a squeeze on pay rises and increased prices.

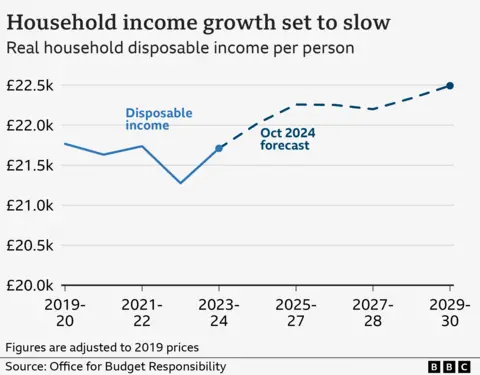

The OBR expects that as a result of the Budget, average household income - which includes the impact of tax changes directly and indirectly, and benefits - will increase only slowly over the parliament.

However, the income growth is slightly faster than the 0.3% average annual growth between 2019 and 2024, a period which saw a number of economic blows, including Brexit, the pandemic and energy price rises following Russia's invasion of Ukraine.

The effect of an ageing population is also putting more stress on public finances, especially through higher demand for health services.

By 2028 real weekly wages - with price rises taken into account - will have grown by just £13 over the past two decades, according to the Resolution Foundation, which aims to improve living standards for low-to-middle income families.

The Institute for Fiscal Studies (IFS) said the rise in employer NICs will affect larger firms hiring people on low wages the most, and could lead to fewer minimum wage jobs being available in future.

The IFS also warned there could be more spending increases and more tax rises to come over the next two years.

The chancellor insisted on Wednesday that her huge revenue-raising Budget was a one-off move to "wipe the slate clean" and not something she "would want to repeat".

But Paul Johnson, head of the IFS, told the BBC that pressures to keep spending on public services would be hard to resist.

"I suspect we’ll end up with even more spending, possibly considerably more spending than is currently planned," he said.

"That will probably mean, unless she gets lucky with growth, more tax rises to come next year or the year after."

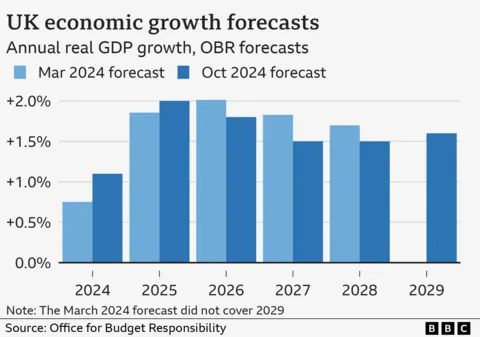

Economic forecasts published by the OBR alongside the Budget suggest UK growth will pick up over the next two years, but then fall back to a more moderate pace, in large part due to Budget measures that are likely to push up prices and interest rates.

Mr Johnson described the forecasts as "pretty awful".

The Resolution Foundation also warned that the decision to frontload increases to spending on public services into this year and next means the Spending Review in the Spring will be tough.

Reeves has also left herself with a "relatively slim margin of headroom", it said.

The chancellor's new debt rule allows more room for manoeuvre but most of that money has already been used up, which means that even a small economic downturn could force the government to increase taxes further in the future, the think tank said.

Movie

Movie 2 months ago

33

2 months ago

33

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)