Kevin PeacheyCost of living correspondent

Getty Images

Getty Images

On the face of it, there is relatively little festive cheer for your finances in the latest inflation figures.

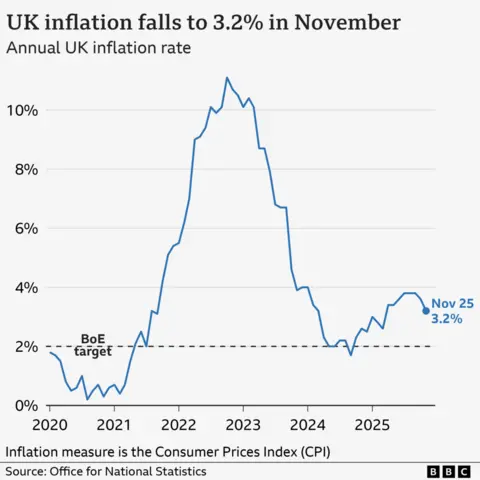

Prices have risen by 3.2% compared with a year ago. If you filled your virtual shopping bag with goods and services at a cost of £100 a year ago, the same selection will now cost £103.20.

The rate of rising prices is well above the Bank of England's target of 2%, and some items are still rocketing up in price. Chocolate, arguably central to the family diet at Christmas, is 17% more expensive than a year ago.

But, crucially, there are now clear signs that prices are going up at a slower rate. That bodes well for next year, and more immediately for the cost of borrowing.

And, with essentials driving the slowdown, the latest data will be welcomed by those who feel particularly stretched by the cost of living.

Pasta, sugar and flour prices fall

The rate of inflation, which charts the rising cost of living, has overcome its recent mini-peak, according to analysts.

The mountainous height of inflation was in October 2022 when the rate hit 11.1%. The rate then fell, but there was an uptick in the late summer of 2025, reaching 3.8%.

And it was the price of food - an essential for consumers - driving November's drop in inflation.

Food and non-alcoholic drinks rose by 4.2% in the year to November, compared to 4.9% in October. Alcohol and tobacco were up 4% compared to 5.9% in October.

Moving in the opposite direction to chocolate, and beef and veal (which rose by nearly 28% in a year), were olive oil (down 16%) as well as drops in price for flours, pasta and sugar.

Importantly, food is essential spending. When the price rises slow, this is much better news for those on lower incomes who see a bigger proportion of their income spent on things that it is impossible to do without.

Sarah Coles, head of personal finance at investment firm Hargreaves Lansdown, said this was also helpign the overall inflation rate drop faster than expected: "It has been following the path the Bank of England had forecast - peaking in September and gradually moving south."

Will the good news last?

The reasons for slowing price riese are often specific to individual items.

For example, the drop in the price of olive oil is primarily the result of a recovery in harvests after some particularly bad years of heatwaves and drought in Greece and Turkey.

Clothing and footwear prices fell by 0.6% in the year to November compared to a rise of 0.3% in October.

This has been linked to shops bringing forward Black Friday discounts due to weak sales as shoppers struggle with the cost of living pressures.

Lucy says home bakers are making the most of what they have

Consumers, too, have changed their habits owing to the financial climate of recent years.

Lucy Fairs, who helps run a cake-sharing social club, called Band of Bakers in Camberwell, London, said that, over the last five years, they had started using what they already had in their cupboards, rather than buying extra special ingredients.

Costa Christou says he chooses recipes carefully

"When I chose a recipe for today, I thought of the theme - but, more so, I thought of what I already had in my pantry," said club member Costa Christou.

Impact on borrowing and saving

The rising cost of goods and services has an impact on the money you save or earn. Inflation erodes the spending power of money you've got saved and - unless you get a pay rise - of your salary.

Analysts say the latest inflation data strengthens the likelihood of a cut in interest rates by the Bank of England's Monetary Policy Committee on Thursday.

That should make it cheaper for consumers to borrow money, but bring lower returns for savers.

"Lower inflation is good news for household budgets, but it is a different story for savers," said Sally Conway, savings commentator at Shawbrook Bank.

"Some savings will inevitably take a hit over Christmas. The key is what happens next. Once the dust settles, it's worth checking whether remaining cash is working hard enough."

Policymakers are trying to encourage more people to invest their money in stocks and shares - which they say is likely to bring higher returns over time than cash savings.

It is why the Financial Conduct Authority has given the go-ahead for targeted support - a scheme that, for the first time, allows banks and financial firms to give suggestions about where to invest your money.

Additional reporting by Josh McMinn

Movie

Movie 2 hours ago

6

2 hours ago

6

![Presidents Day Weekend Car Sales [2021 Edition] Presidents Day Weekend Car Sales [2021 Edition]](https://www.findthebestcarprice.com/wp-content/uploads/Presidents-Day-Weekend-car-sales.jpg)

English (United States)

English (United States)